More in Affairs Now

-

Ekamra Utsav Wraps Up with Anticipation High for Next Year

Share the newsThe curtains have fallen on Ekamra Utsav, that aimed at showcasing of art, culture, and linguistic diversity, hosted by...

February 9, 2024 -

Dilip Tirkey: Beyond the Sport, a photo exhibition by Shamim Qureshy

Share the newsA photo exhibition titled ‘Dilip Tirkey: Beyond the Sport,’ by noted photojournalist Shamim Qureshy was inaugurated at the Kalinga...

November 24, 2023 -

India vs Sri Lanka : massive 302 runs victory for India

Share the newsIndia enters semis after thrashing Sri Lanka by 302 runs. Sri Lanka’s entire battling line-up collapsed in 19.4 overs...

November 2, 2023 -

Awaaken Trust Leads Cuttack’s Grand Rally Against Breast Cancer

Share the newsIn a remarkable show of unity and solidarity, more than 10 social organizations in Cuttack, along with 180 enthusiastic...

October 31, 2023 -

Fashion With Purpose – Ethically Rich Collection At Indyloom

Share the newsIndyloom, a leading name in the world of ethnic fashion, opened its latest store in bhubaneswar. It will showcase...

September 29, 2023 -

Flipkart Big Billion Days Sale 2023 dates announced

Share the newsFlipkart, has announced its Big Billion Days Sale 2023 dates. It will begin from October 8, 2023 and go...

September 28, 2023 -

Former Speaker & BJD MLA Surjya Narayan Patro passes away

Share the newsFormer Odisha Assembly Speaker and Digapahandi MLA Surjya Narayan Patro passes away at a private hospital in Bhubaneswar at...

September 2, 2023 -

‘Chulas’ Destroyed In Gundicha Temple

Share the newsThe Ratha Yatra witnesses the Lords taking a trip on their chariots to their janma bedi, ‘Maa Gundicha’s Temple’...

July 2, 2022 -

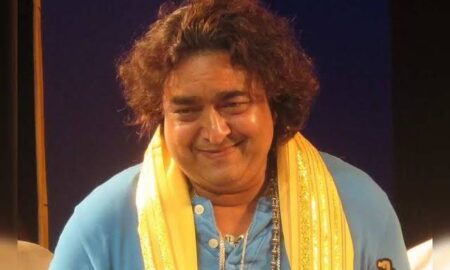

Ollywood Actor Rai Mohan Parida No More!

Share the newsKnown for his villainous roles in over 100 Odia movies, Rai Mohan Parida committed suicide. His body was found...

June 24, 2022